50/30/20 Rule: How to Budget Your Income Smarter and Save More Effectively

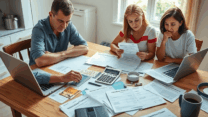

Managing your personal finances can feel overwhelming, especially when you’re trying to balance living expenses, debt payments, and savings goals. Fortunately, the 50/30/20 rule offers a simple yet effective framework to help Americans take control of their money. This budgeting method is not only easy to follow but also adaptable to different income levels and lifestyles. In this post, we’ll explore how the 50/30/20 rule works, why it’s beneficial, and how you can apply it to your financial life in the United States.

What Is the 50/30/20 Rule?

The 50/30/20 rule is a budgeting guideline that divides your after-tax income into three broad categories:

– 50% for Needs

– 30% for Wants

– 20% for Savings and Debt Repayment

This rule was popularized by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan.” It’s designed to help individuals and families create a balanced budget that prioritizes both current obligations and future financial security.

Breaking Down the Categories

50% for Needs

Needs are essential expenses that you must pay to live and work. These include:

– Rent or mortgage payments

– Utilities (electricity, water, gas)

– Health insurance premiums

– Car payments and gas

– Minimum loan payments

– Groceries

If your needs exceed 50% of your income, you may need to make adjustments—such as downsizing your home or shopping for more affordable insurance options.

30% for Wants

Wants are non-essential expenses that enhance your lifestyle. Examples include:

– Dining out

– Entertainment (movies, concerts, streaming services)

– Travel and vacations

– Gym memberships

– Shopping for clothes or gadgets

While these expenses aren’t necessary for survival, they contribute to your quality of life. Allocating 30% of your income for wants allows you to enjoy life without overspending.

20% for Savings and Debt Repayment

This category focuses on building your financial future. It includes:

– Emergency fund contributions

– Retirement savings (401(k), IRA)

– Extra payments on student loans or credit card debt

– Investments

Financial experts recommend having at least 3–6 months’ worth of living expenses in an emergency fund. Prioritizing savings and debt repayment helps you avoid financial stress and build long-term wealth.

How to Apply the 50/30/20 Rule in the U.S.

To use this rule effectively, follow these steps:

1. Calculate your after-tax income. This is your take-home pay after federal, state, and FICA taxes. If you’re self-employed, subtract estimated taxes and business expenses.

2. Categorize your spending. Review your bank statements and categorize each expense as a need, want, or savings/debt repayment.

3. Adjust as needed. If your spending doesn’t align with the 50/30/20 rule, make changes. For example, reduce dining out to free up more money for savings.

Benefits of the 50/30/20 Rule

– Simplicity: It’s easy to understand and implement.

– Flexibility: It works for a wide range of income levels.

– Balance: It ensures you’re not neglecting savings while enjoying life.

– Financial awareness: It encourages you to track and evaluate your spending habits.

Limitations to Consider

While the 50/30/20 rule is a great starting point, it may not fit everyone’s financial situation. For example:

– High cost-of-living areas (like San Francisco or New York City) may require more than 50% of income for needs.

– Individuals with significant debt may need to allocate more than 20% to debt repayment.

In such cases, it’s okay to adjust the percentages to better suit your circumstances.

Tools to Help You Budget

Several budgeting tools and apps can help you implement the 50/30/20 rule:

– Mint (mint.intuit.com)

– YNAB (You Need A Budget)

– EveryDollar

– Personal Capital

These tools allow you to track spending, set goals, and stay on top of your finances.

Conclusion

The 50/30/20 rule is a practical and straightforward way to manage your money. By dividing your income into needs, wants, and savings, you can create a sustainable budget that supports both your present lifestyle and future goals. Whether you’re just starting your financial journey or looking to improve your money habits, this rule can serve as a solid foundation.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Please consult with a certified financial planner or tax advisor before making any financial decisions. The author and publisher are not responsible for any financial losses or damages resulting from the use of this information.

Sources

– Warren, Elizabeth, and Amelia Warren Tyagi. “All Your Worth: The Ultimate Lifetime Money Plan.”

– Consumer Financial Protection Bureau (cfpb.gov)

– U.S. Department of Labor (dol.gov)

답글 남기기