How to Track Your Spending: Best Tools & Budgeting Tips for Smarter Money Management

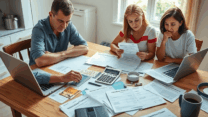

Managing your personal finances effectively starts with one essential habit: tracking your spending. Whether you’re saving for a big purchase, paying off debt, or simply trying to live within your means, understanding where your money goes is the first step toward financial freedom. In this guide, we’ll explore the best tools and budgeting tips tailored for Americans, helping you take control of your money with confidence and clarity.

Why Tracking Your Spending Matters

Tracking your spending helps you make informed decisions, identify wasteful habits, and stay aligned with your financial goals. According to the Consumer Financial Protection Bureau (CFPB), regularly monitoring your expenses can reduce financial stress and improve overall well-being. It’s not just about cutting costs—it’s about spending intentionally.

Top Tools to Track Your Spending

There are many digital tools available in the U.S. that make tracking your expenses easier than ever. Here are some of the most reliable and user-friendly options:

1. Mint – Owned by Intuit, Mint connects to your bank accounts, credit cards, and bills to automatically categorize and track your spending. It also provides budgeting tools and credit score monitoring.

2. You Need a Budget (YNAB) – YNAB uses a zero-based budgeting method, encouraging users to assign every dollar a job. It’s great for people who want to be more intentional with their money.

3. Personal Capital – While it’s known for investment tracking, Personal Capital also offers excellent budgeting features. It’s ideal for those who want to manage both spending and long-term wealth.

4. Goodbudget – Based on the envelope budgeting system, Goodbudget allows you to plan your spending ahead of time. It’s perfect for couples or families who want to budget together.

5. Spreadsheets – For those who prefer a hands-on approach, using Excel or Google Sheets can be a powerful way to track spending manually. Templates are available online, or you can customize your own.

Budgeting Tips for Smarter Money Management

Even with the best tools, effective budgeting requires good habits. Here are some expert tips to help you stay on track:

– Set Clear Financial Goals: Whether it’s saving for a vacation, building an emergency fund, or paying off student loans, having a goal gives your budget purpose.

– Use the 50/30/20 Rule: This popular rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings or debt repayment. It’s a simple framework to guide your spending.

– Review Weekly: Set aside time each week to review your transactions. This helps you catch errors, avoid overdrafts, and adjust your budget as needed.

– Automate When Possible: Automate bill payments and savings contributions to reduce the risk of missed payments and ensure consistent progress toward your goals.

– Cut Unnecessary Subscriptions: Review recurring charges and cancel services you no longer use. Many Americans are surprised by how much they spend on unused subscriptions.

Common Mistakes to Avoid

Even with the best intentions, it’s easy to fall into bad habits. Avoid these common pitfalls:

– Ignoring small purchases: Daily coffee runs or app subscriptions can add up quickly.

– Not adjusting your budget: Life changes—your budget should too.

– Forgetting irregular expenses: Plan for annual costs like car registration or holiday gifts.

How to Stay Motivated

Tracking your spending can feel tedious at first, but staying motivated is key. Celebrate small wins, such as sticking to your grocery budget or paying off a credit card. Consider joining online communities or using gamified apps that reward progress.

Final Thoughts

Tracking your spending is a foundational skill for anyone looking to improve their financial health. With the right tools and a proactive mindset, you can gain control over your money and make choices that align with your values and goals. Remember, it’s not about perfection—it’s about progress.

Disclaimer

This article is for informational purposes only and does not constitute financial advice. Always consult with a certified financial advisor or tax professional before making major financial decisions. The tools and tips mentioned are based on publicly available information and personal finance best practices in the United States.

Sources

– Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov

– U.S. Department of the Treasury: https://home.treasury.gov

– Federal Trade Commission (FTC): https://www.ftc.gov

답글 남기기