Budgeting Methods That Actually Work: 5 Proven Ways to Take Control of Your Money

Managing your money wisely is more important than ever, especially in a fast-paced economy like the United States. Whether you’re trying to pay off debt, save for a home, or simply get a better handle on your monthly expenses, having a reliable budgeting method can make all the difference. In this post, I’ll walk you through five proven budgeting strategies that actually work—based on expert recommendations and real-life success stories.

1. The 50/30/20 Rule: A Simple Yet Powerful Framework

The 50/30/20 rule is one of the most popular budgeting methods in the U.S., and for good reason. It was popularized by Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan.”

– 50% of your income goes to needs (housing, utilities, groceries, insurance)

– 30% goes to wants (dining out, entertainment, travel)

– 20% goes to savings and debt repayment

This method is ideal for people who want a simple, flexible approach to budgeting. It allows you to prioritize essentials while still enjoying life and planning for the future.

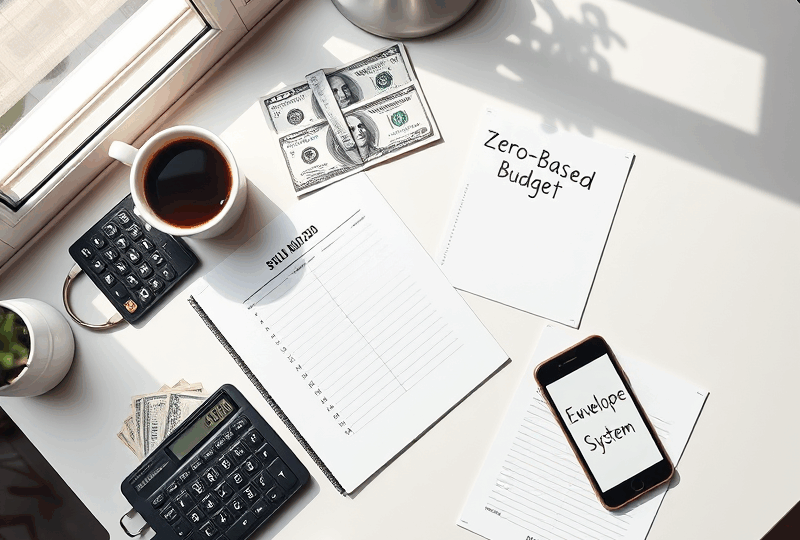

2. Zero-Based Budgeting: Every Dollar Has a Job

Zero-based budgeting (ZBB) requires you to assign every dollar of your income to a specific purpose until you have zero dollars left unallocated. This method is especially effective for people who want to be intentional with every penny they earn.

To implement ZBB:

– List all your income sources

– List all your expenses, including savings and debt payments

– Subtract expenses from income until the balance is zero

This method can be time-consuming but offers unmatched control and clarity. It’s often recommended by financial experts like Dave Ramsey.

3. Envelope System: A Cash-Based Approach

The envelope system is a traditional method that’s still relevant today, especially for those who struggle with overspending. You allocate cash into envelopes labeled for each spending category (e.g., groceries, gas, entertainment). Once the envelope is empty, you can’t spend any more in that category until the next month.

While many people now use digital versions of this method through apps like Goodbudget, the tactile nature of using physical cash can help reinforce spending discipline.

4. Pay Yourself First: Prioritize Saving

This method flips the traditional budgeting approach on its head. Instead of saving what’s left after spending, you save first and spend what’s left.

Here’s how it works:

– Decide how much you want to save each month (e.g., 20% of your income)

– Automatically transfer that amount to a savings or investment account

– Use the remaining funds for bills and discretionary spending

This method is great for building long-term wealth and ensuring your financial goals don’t get sidelined.

5. The Calendar-Based Budget: Align Spending with Paychecks

A calendar-based budget helps you visualize when bills are due and when income arrives. This method is particularly useful for people who live paycheck to paycheck or have irregular income.

Steps to create a calendar-based budget:

– Mark all paydays on a calendar

– Add due dates for all bills and expenses

– Allocate funds from each paycheck to cover upcoming expenses

This method helps prevent overdrafts and late payments, making it easier to stay on top of your finances.

Final Thoughts: Choose What Works for You

There’s no one-size-fits-all approach to budgeting. The best method is the one that fits your lifestyle, goals, and personality. Whether you prefer the structure of zero-based budgeting or the flexibility of the 50/30/20 rule, the key is consistency and awareness.

Disclaimer

This blog post is for informational purposes only and does not constitute financial advice. Always consult with a certified financial advisor or professional before making any financial decisions. The budgeting methods discussed are based on publicly available information and general financial principles. Your individual financial situation may require a customized approach.

Sources

– Warren, Elizabeth, and Amelia Warren Tyagi. “All Your Worth: The Ultimate Lifetime Money Plan.”

– Consumer Financial Protection Bureau (cfpb.gov)

– Dave Ramsey (daveramsey.com)

답글 남기기