First-Time Homebuyer Mistakes: Top Pitfalls to Avoid When Buying a Home in the U.S.

Buying your first home is an exciting milestone, but it can also be overwhelming. As a U.S. resident, navigating the complex housing market, mortgage process, and legal considerations can be daunting. Many first-time homebuyers make costly mistakes simply due to lack of experience. In this post, I’ll walk you through the most common pitfalls and how to avoid them, so you can make informed, confident decisions on your journey to homeownership.

Not Getting Pre-Approved for a Mortgage

Before you even start house hunting, it’s essential to get pre-approved for a mortgage. Many first-time buyers confuse pre-qualification with pre-approval. Pre-qualification is a basic estimate, while pre-approval involves a more thorough check of your financial background. Without pre-approval, you risk falling in love with a home you can’t afford or losing out to buyers who are already pre-approved.

According to the Consumer Financial Protection Bureau (CFPB), pre-approval gives you a clearer picture of your budget and strengthens your offer in a competitive market.

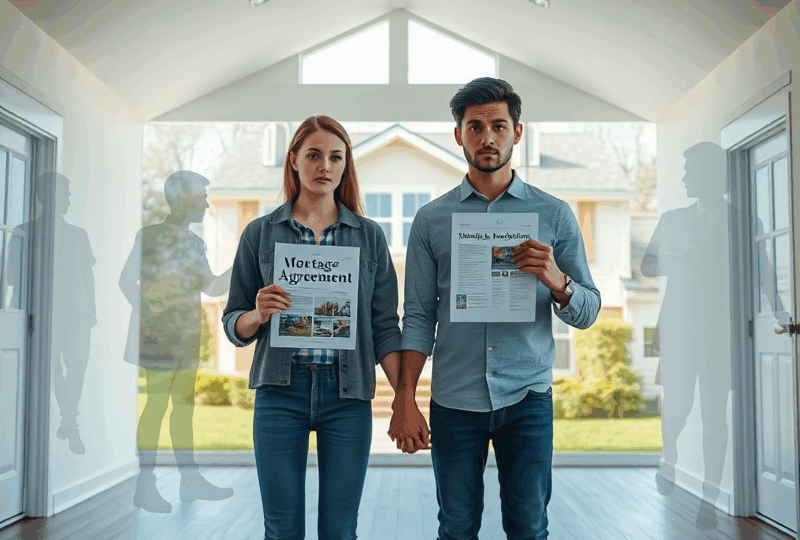

Underestimating the Total Cost of Homeownership

Many buyers focus solely on the down payment and monthly mortgage, but owning a home involves more than that. Property taxes, homeowners insurance, maintenance, HOA fees, and utilities can add up quickly. Failing to budget for these costs can lead to financial strain or even foreclosure.

A good rule of thumb is to set aside 1% to 3% of your home’s value annually for maintenance and repairs. Also, use online calculators from trusted sources like the National Association of Realtors (NAR) to estimate total monthly housing costs.

Skipping the Home Inspection

In a hot market, some buyers waive inspections to make their offers more attractive. However, skipping a home inspection can be a costly mistake. A professional inspection can uncover hidden issues like foundation problems, mold, or outdated electrical systems.

The American Society of Home Inspectors (ASHI) recommends always hiring a certified inspector to evaluate the property. The few hundred dollars you spend upfront could save you thousands in repairs later.

Not Researching the Neighborhood

A beautiful home in the wrong neighborhood can quickly become a regret. Consider factors like school districts, crime rates, commute times, and future development plans. Websites like NeighborhoodScout and local government planning departments can provide valuable insights.

Visit the neighborhood at different times of day and talk to residents if possible. This helps you get a feel for the community and avoid surprises after moving in.

Overextending Your Budget

It’s tempting to stretch your budget for a dream home, but doing so can lead to financial stress. Lenders may approve you for more than you can comfortably afford. Stick to the 28/36 rule: spend no more than 28% of your gross monthly income on housing expenses and 36% on total debt.

Use a detailed budget to understand your financial limits and leave room for emergencies, savings, and lifestyle expenses.

Ignoring First-Time Homebuyer Programs

Many first-time buyers miss out on valuable assistance programs. Federal, state, and local governments offer grants, low-interest loans, and tax credits to help reduce the cost of buying a home.

Check resources like HUD.gov and your state’s housing finance agency to explore available programs. These can significantly lower your upfront costs and make homeownership more accessible.

Failing to Shop Around for a Mortgage

Don’t settle for the first mortgage offer you receive. Interest rates, fees, and terms can vary widely between lenders. According to Freddie Mac, getting at least three quotes can save you thousands over the life of your loan.

Compare annual percentage rates (APRs), not just interest rates, and ask about closing costs, prepayment penalties, and other fees.

Not Understanding the Mortgage Terms

Mortgages come with complex terms that can be confusing. Make sure you understand the difference between fixed-rate and adjustable-rate mortgages, loan terms, and amortization schedules.

Ask your lender to explain anything you don’t understand. The CFPB offers a helpful mortgage glossary and tools to compare loan options.

Letting Emotions Drive the Purchase

Buying a home is emotional, but letting your heart overrule your head can lead to poor decisions. Avoid bidding wars that push you over budget or ignoring red flags because you’re in love with a property.

Work with a trusted real estate agent who can provide objective advice and help you stay grounded throughout the process.

Closing Without Reviewing All Documents

The closing process involves signing a mountain of paperwork. It’s crucial to review every document carefully and ask questions. Mistakes or unexpected fees can slip through if you’re not vigilant.

Request the Closing Disclosure at least three days before closing and compare it to your Loan Estimate. If anything looks off, speak up before signing.

Conclusion

Buying your first home in the U.S. is a significant achievement, but it comes with challenges. By educating yourself and avoiding these common mistakes, you can protect your investment and enjoy a smoother path to homeownership. Remember, preparation and knowledge are your best tools.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or real estate advice. Always consult with a licensed real estate professional, mortgage advisor, or attorney before making any real estate decisions. The author and publisher are not liable for any actions taken based on the information provided in this article.

답글 남기기