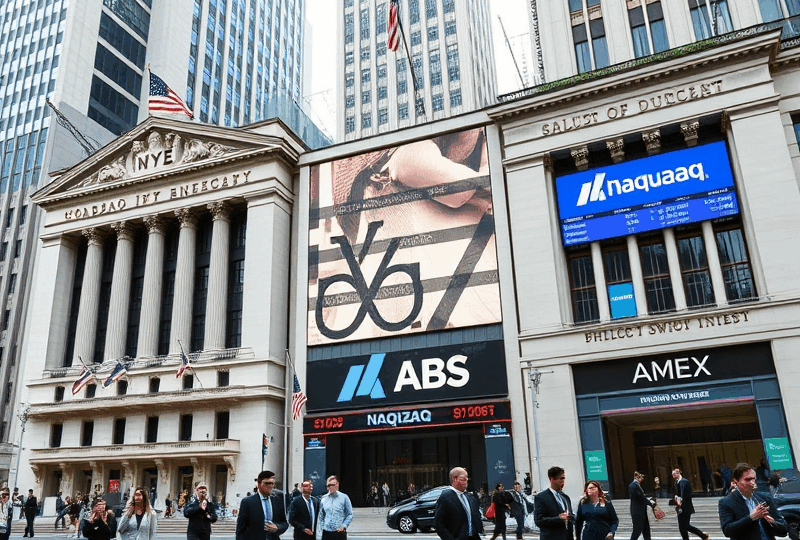

US Stock Markets Explained: Differences Between NYSE, NASDAQ, and AMEX Every Investor Should Know

Investing in the U.S. stock market can be both exciting and overwhelming, especially when trying to understand the differences between the major stock exchanges. As an American investor, whether you’re a beginner or looking to deepen your financial knowledge, it’s crucial to understand how the New York Stock Exchange (NYSE), NASDAQ, and the American Stock Exchange (AMEX) operate. Each exchange has its own history, structure, and role in the financial ecosystem. In this article, we’ll break down the key differences and help you make more informed investment decisions.

What is the NYSE (New York Stock Exchange)?

The NYSE, located on Wall Street in New York City, is the oldest and largest stock exchange in the United States. Founded in 1792, it has long been considered the epicenter of global finance. The NYSE operates as an auction market, where buyers and sellers trade through a physical trading floor and electronic systems.

Companies listed on the NYSE are typically large, well-established firms. These include blue-chip companies like Coca-Cola, IBM, and Johnson & Johnson. To be listed, companies must meet strict financial and regulatory requirements, which adds a layer of credibility and stability.

One of the defining features of the NYSE is the presence of Designated Market Makers (DMMs), who help maintain fair and orderly trading by matching buy and sell orders.

What is NASDAQ?

NASDAQ, short for the National Association of Securities Dealers Automated Quotations, was founded in 1971 and was the world’s first electronic stock exchange. Unlike the NYSE, NASDAQ does not have a physical trading floor. All transactions are conducted electronically, which allows for faster and more efficient trading.

NASDAQ is known for being home to many technology and growth-oriented companies, such as Apple, Microsoft, Amazon, and Tesla. The exchange is often associated with innovation and volatility, given the nature of the companies it lists.

NASDAQ operates as a dealer market, where market makers—usually large financial institutions—provide liquidity by buying and selling stocks from their own inventories.

What is AMEX (American Stock Exchange)?

The American Stock Exchange, now known as NYSE American after being acquired by the NYSE in 2008, was historically a smaller exchange that focused on small-cap stocks and exchange-traded funds (ETFs). AMEX played a significant role in developing the ETF market in the U.S.

NYSE American uses a hybrid market model that combines both electronic and floor-based trading. It’s particularly attractive to smaller companies that may not meet the stringent listing requirements of the NYSE or NASDAQ.

Although it doesn’t have the same volume or visibility as the other two exchanges, AMEX remains an important platform for emerging companies and niche investment products.

Key Differences Between NYSE, NASDAQ, and AMEX

- Trading Method: NYSE uses a hybrid model with a physical trading floor; NASDAQ is fully electronic; AMEX also uses a hybrid model.

- Company Types: NYSE lists large, established firms; NASDAQ lists tech and growth companies; AMEX focuses on small-cap and ETFs.

- Market Type: NYSE is an auction market; NASDAQ is a dealer market; AMEX combines both models.

- Listing Requirements: NYSE has the most stringent requirements, followed by NASDAQ, then AMEX.

Why Does It Matter to Investors?

Understanding where a stock is listed can give you insights into the company’s size, financial health, and growth potential. For example, a company listed on the NYSE may offer more stability, while a NASDAQ-listed firm might provide higher growth potential but with more risk. AMEX-listed stocks can be appealing for investors looking for emerging opportunities or niche markets.

Moreover, the exchange can affect trading costs, liquidity, and volatility. Stocks on NASDAQ, for instance, often experience higher volatility, which can be both an opportunity and a risk depending on your investment strategy.

Final Thoughts

Whether you’re investing for retirement, building a diversified portfolio, or simply exploring the stock market, knowing the differences between NYSE, NASDAQ, and AMEX is essential. Each exchange serves a unique purpose and caters to different types of companies and investors. By understanding their structures and characteristics, you can make more informed and strategic investment decisions.

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Always consult with a licensed financial advisor or investment professional before making any investment decisions. The information provided is accurate to the best of our knowledge at the time of writing but may be subject to change.

Sources

- New York Stock Exchange – www.nyse.com

- NASDAQ – www.nasdaq.com

- U.S. Securities and Exchange Commission (SEC) – www.sec.gov

답글 남기기